Documentation is of key importance to sourcing funds for your business. The process, although time-consuming demonstrates the real financial character of your business to the potential investors/lenders. Its ability to summarize and tell the story of your business helps investors and lenders understand the journey of your business from its origins to today and beyond.

Before approaching any investor/lender it is important to ask yourself, Is my business fundable?

SMEs trying to secure funding for expansion, often run into difficulty with financial institutions and potential investors as a result of poor documentation. Conversely, proper documentation validates your current position and provides assurance to your lenders.

Large enterprises are not exempted from this either; no lender/investor trusts an organization that practices disorganized reporting and accounting processes. When your paperwork is sound, up-to-date, and in compliance with the authorities, it gives you an edge.

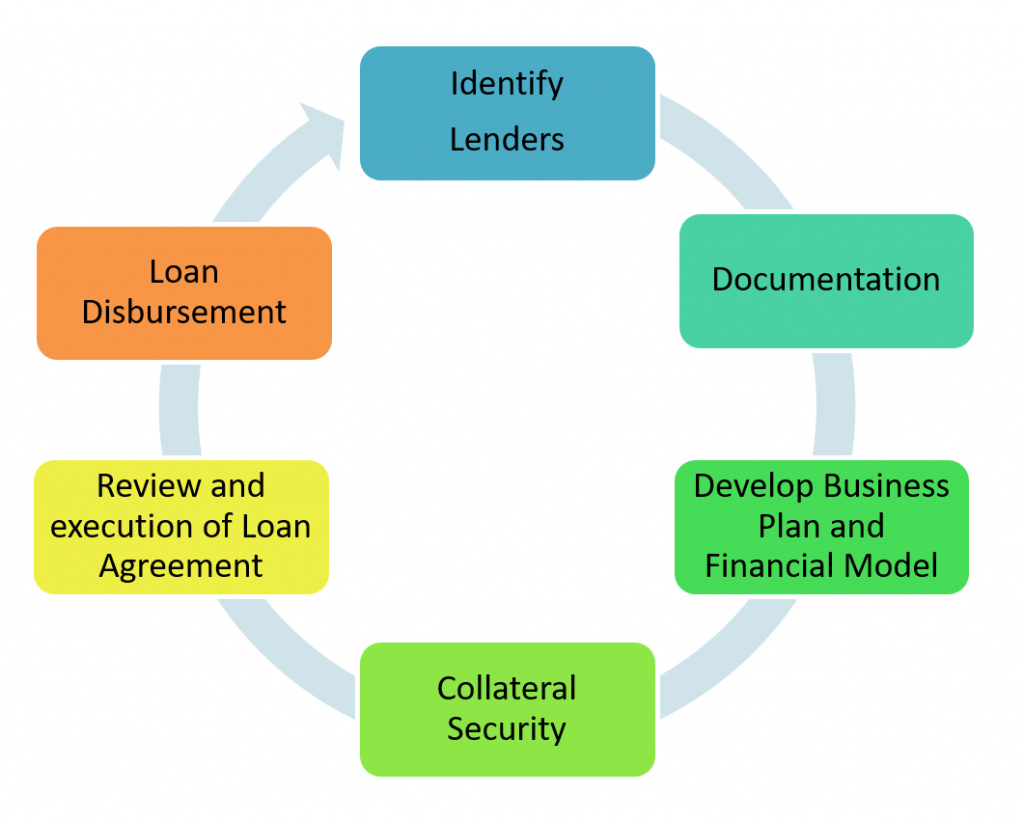

Stages of Documentation for fundraising is as follows

1. High level

Documents required in this phase include the financial plan and business plan.

- Business plan is a fundamental document used to attract investment before a company has established a proven track record. This is required prior to beginning operations. Lenders and inventors often make writing a viable business plan a prerequisite before considering providing capital to businesses. It consists of your business idea and model to ensure it is viable.

- The suite of Financial Statements is an evaluation matrix of a company’s financial health. The ability to understand your reports is crucial for your company’s ability to raise funds. Both your historical financial data and projected financial figures are required as part of the application process. Banks and investors will analyse your company’s financial journey, determining if its trajectory fits within acceptable risk parameters. The lender will write a credit review to enable them explore the risks and perform financial due diligence.

2. Detailed

Documentation required in the phase circles around collateral and security

Lenders often require collateral and security which can range from property, and/or physical assets to financial assets. These act as a protection against potential losses for the lender, should your organization default in repayments. In such an event, the collateral becomes the property of the lender to compensate for the unreturned borrowed money.

3. Deep dive

Documentation required in this phase includes the offer document or term sheet and loan agreement. A loan agreement is a final documentation, in which the terms and conditions are based for both lender and borrower. This document states the interest rate, the repayment period, the collateral (if any), and other special conditions.

Westsons Financial Services provides investment advice and assistance to individuals/organizations with regard to investments and borrowing. We have adopted a proven methodology for funds raising and are committed to working with various financial institutions that make access to funds a seamless process.

The guidance through our methodology is the best way to ensure completeness in the documentation process and to understand which relevant financial institution is suitable for your organization.